- Milly Barker

- Aug 25, 2025

- 11 min read

Updated: Sep 24, 2025

We've reached the penultimate article in the Investment Readiness series.

In this series of articles, we're learning about all the critical areas of your business that investors will inspect when you're going out and asking them for sweet, sweet piles of cash to build your dreams.

We're covering:

Strategy: how to define, refine, and document your path forward

Operations: assessing and optimising for genuine scalability

Finance: building robust models and projections that stand up to scrutiny

Data Room/Collateral: preparing comprehensive due diligence materials and data rooms

Coaching: getting ready for the tough questions with investment meeting and Q&A coaching (this article)

Investment Strategy: mastering cap table planning and investor identification

I'm writing this series (in part, I'm also writing it because it's really useful) because we just launched a new Investment Readiness service to help startup and scaleup Founders and Operators get the best raises on the best terms by honing their operational effectiveness - we call that service 'Op Eff It' because there are few things I love more than a cute play on words.

If this is the first article you're reading in the series, I recommend checking out the previous ones in the links above as they set the context for this one.

Or, if you can't wait for the rest of the series, why not get ahead of the game and take Op Eff It's free Investment Readiness Healthcheck to assess how you're doing right now across all 6 of the categories?

I’ve, once again, got my new favourite co-author with me, Will Herrmann.

Will has partnered with me on Op Eff It and brought a huge amount of his expertise to the table. Will has over 20 years of experience in strategy, operations and finance having spent ten years in management consultancy with Accenture before moving into COO/CFO roles in startup, VC and charity, so he brings broad and really rare perspective as well as extensive practical experience to the topic of Investment Readiness and I’m excited for you to hear his thoughts.

Ok, let’s talk about how to get ready for some of the most important meetings of your (professional) life. So far, you've crafted your Strategy (the map of where you’re taking the business), you’ve fine-tuned your operations (what’s powering you forwards). You’ve also built your finances (how you showcase how well it’s all working) and you've got everything ready to be inspected in your data room.

To get to the point where you're ready to have actual conversations with investors, a lot of work has already gone into this raise and I hate to be the bearer of more work for your to-do list, but all of that means nothing if you can’t confidently articulate it to the people who hold the purse strings.

In this article, we're talking about getting you ready - not the business, so much, but you as the person who is going to sell the hell out of that business to very busy people with a lot of other people to speak to. We’ll be diving into the fine art/science of investor conversations, from anticipating the tough questions to having a strong presence in the room itself (whether that room is physical or virtual).

This is such a crucial step for your raise - we need to turn all of your preparation into confidence (without accidentally landing on arrogance) so that your business's story gets the brilliant ending it deserves.

What actually is an 'investor meeting'?

We've talked about what a good business looks like from an investor's perspective, but now let's talk about what a successful fundraising process looks like from the other side of the table - i.e. yours.

The process from first (virtual or actual) handshake to a signed term sheet can be lengthy and it can feel like you're on a never-ending conveyor belt of conversations but each interaction you have with your potential investors will tell them something (ideally something great) about you and your business and so they're all incredibly important.

In an earlier-stage business (so pre-seed to around Series A, which is the stage our Investment Readiness services are tailored for), you should expect to have between 3 and 5 meetings with each investor you’re seriously engaging with. However, it's really worth mentioning here that, to close a Pre/Seed or Series A round, you’ll likely have to go through some parts of that process with something like 50-100 investors to land the right deal. You won't get to the later stages with all of those investors but, because you're likely an unknown entity and your entrepreneurial genius is, as yet, unproven, you're going to be kissing a lot of frogs when you get started.

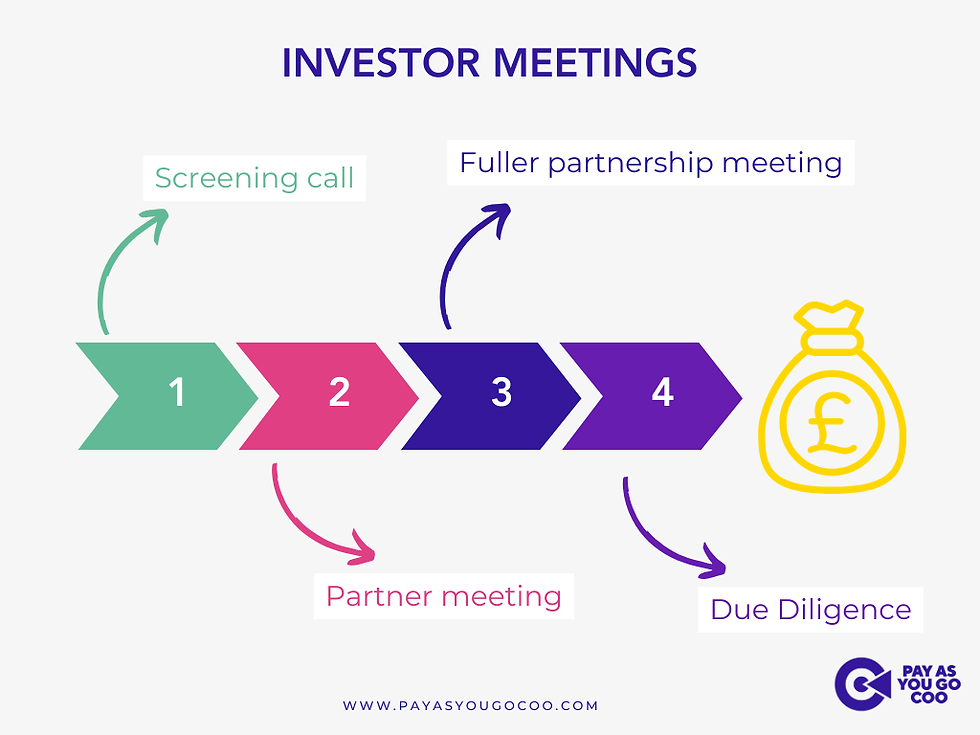

Here’s a breakdown of the types of meetings you can expect to have:

(n.b. all of the details below are what you can expect to happen if you're taking to an institutional investor of some kind (e.g., not a fund). If you're talking to an Angel investor you may just meet with them throughout or perhaps them and an advisor or two. Please also note that these are the highlights of the process - if we wrote out every single email and chat that can happen during the process you'd still be reading this article in a year's time).

The introduction/screening call:

Who's there? You, as the founder (or your founding team), and one or two junior investors (like an Analyst or Associate). This is the initial test of you and your ideas.

What's expected? You'll give a concise, high-level pitch of your business, typically lasting 15-20 minutes. At this stage, they're looking for a quick sense of whether your company fits their fund's thesis and whether you're worth a Partner's time. No Analyst or Associate wants to be known for wasting Partners' time, so you want to make sure you can get across, very concisely, the value of what you're offering.

The Partner meeting:

Who's there? You, the Analyst or Associate you met with, and one or two Partners. This is the first proper step into the fuller process of raising a round for your business.

What's expected? This is a much deeper dive than the screening call; be ready to give your full, detailed pitch and then face a more probing Q&A. They'll be challenging your assumptions, digging into your numbers, and testing your strategic thinking. Don't forget that the people in this meeting with you will have at least some understanding of your industry niche and will have experience of investing in companies at a similar stage to yours, so you need to be ready to prove that you know what's what.

A fuller partnership meeting:

Who's there? This one will depend on the fund, but will be something like you and more of/the entire investment team, maybe even including their Investment Committee (IC)*. This is one of the final hurdles before a term sheet.

What's expected? You'll likely present your pitch one last time, but the focus will be a very intense, and probably quite high-pressure Q&A. You'll have to defend your business model, address any final concerns, and prove to every person in the room that you're the right bet. Investors have to make sure they can really back up their belief in your business's potential to turn their investors' money into more money and so they're going to dig DEEP.

Remember, before this kind of meeting can happen, there will have been a lot of internal discussion happening about your business - assumptions will have been made that you might need to reinforce but you also might need to refute.

*The Investment Committee (the IC), is the final decision-making body within a Venture Capital firm or other investment organisation. It’s typically composed of all the firm’s Partners or senior investment professionals. The IC's primary role is to evaluate and approve or reject potential investment opportunities. While a Partner may champion a deal and bring it to the committee, the IC conducts a final, rigorous review to ensure the investment aligns with the fund’s strategy and risk profile.

The Due Diligence deep dive:

Who's there? You, relevant members of your team (e.g., COO, CTO, CFO), and the investor's Due Diligence team (lawyers, accountants, etc.).

What's expected? This isn't so much a single meeting as a series of back-and-forth questions. At this point, they'll be verifying every single claim you've made. Your job is to provide full, transparent information about all the documents in your data room, introduce the DD team to your team, and answer any and all specific, technical questions they have.

What should you be prepared to answer at each stage of the investment process?

The key question in the back of an investor's mind will be the same at each stage of the process - can this business turn our money into more money - but the way that they'll dig down to find answers to this will differ at each stage. The idiosyncrasies of your business will add a specific flavour to what you're being asked and the more technical your product is, the more technical some of the questions will be.

However, here's a rough starting guide to help you prepare answers for each of the stages above:

Introduction/screening call

At this initial stage, the Analyst/Associate is looking for a quick, high-level understanding to determine if you're a good fit for a Partner's time. They will likely focus on the basics, such as:

Problem: What's the core problem you're solving, and why is it so painful for your customers?

Solution: What have you built to solve it, and how does it work?

Market: How big is the market you're going after, and how is it growing?

Traction: What key metrics can you share that prove people are using and loving your product?

Team: Why is your team the right one to tackle this problem?

Partner meeting

This is a much deeper dive. The Partners are now testing your assumptions, your resilience, and your vision. You should be prepared for more challenging questions.

Strategy & Vision: What's your long-term vision, and how does this round of funding help you achieve it?

Competition: Who are your main competitors, and what's your defensible advantage? Why can't they just copy what you're doing?

Operations: Walk me through your customer acquisition process from start to finish. What are the key bottlenecks in your operations?

Finance: What are your unit economics, and how do they change as you scale? How did you arrive at your key financial projections?

The Ask: How much are you raising, what are you spending it on, and what milestones will you hit with this capital?

Fuller partnership meeting

This is the most rigorous stage. You could find yourself facing questions from the entire IC, and they'll be looking for inconsistencies or weaknesses. Be prepared to defend your business from every angle.

Contrarian Viewpoints: "A partner on our team believes [x] is a major risk. How would you respond to that?"

Market Dynamics: What are the biggest threats on the horizon that could disrupt your business?

Team & Culture: As you scale, how do you plan to maintain your culture and attract top-tier talent?

The "Why": What drives you personally to solve this problem, and what are you most afraid of?

The Exit: What does a successful exit look like for this business, and how do we get there?

Due Diligence deep dive

At this stage, the questions are less about the 'why' and more about the 'what'. The investors are verifying every claim with hard data.

Financials: Can you show us the breakdown of your revenue and expenses for the last 12 months? How do these figures compare to your projections?

Operations: Please provide your standard operating procedures for [x] process. How do you ensure consistency and quality at scale?

Legal: Can you show us your intellectual property documentation? How are your employment contracts structured?

Team: Can you introduce us to the rest of your leadership team and walk us through their roles and responsibilities?

Customers: Can we speak with a few of your key customers to validate their experience with your product?

I know, right? It's a lot. And don't forget that you'll also be actually running and growing your business (and possibly running out of cash in the process) whilst having these conversations with 50-100 different people. It's enough to make your head spin.

If it feels overwhelming, why not book a free, no-strings call with us to get an idea of how much of this work you've actually already done and how much needs to be done?

We've spent years getting to know what investors look for and one of the things we offer in our Investment Readiness service is having someone alongside you for the duration of the raise so you can get the funds you need without losing your mind - and so you can stay as focused as possible on what you do best: building a great company.

If that sounds like something you’d enjoy, why not book a free, no-strings call with us to learn more.

How do you know if you're ready to talk to investors?

I know this seems like a lot of work to go through after you've already been through a lot of work but it's so, so important to get this part of your fundraise right.

Before you even think about firing off an email or asking for an intro, please, please know this: you only get one shot to make a first impression on anyone, but especially on an investor. Jumping the gun and starting conversations before you’re truly ready can be incredibly damaging. A 'no' from a good investor today is often a 'no' for good. You don’t want to waste your one opportunity by pitching an unfinished story.

Use these ten questions as your final gut check. If you can't confidently answer 'yes' to all of them, it’s not time yet. Go back, do the work, and get to a place where you're not just ready for a conversation, but ready for a deal - or, give us a shout and we'll help you.

Is your business Strategy clearly defined and defensible, with a compelling market opportunity and a unique selling point? If you're still figuring out your place in the market, it's too soon to ask for money.

Can you show compelling, defensible traction (beyond some of the more 'vanity' metrics, like followers or engagements) that proves you're onto something worthwhile? Traction is the ultimate proof that you're not just a dreamer.

Is your financial model robust and realistic, with clear, justified assumptions and a solid grasp of your unit economics? Your numbers must tell a believable story that you can back up with data.

Are your core business operations scalable and able to handle a significant increase in demand without imploding? Investors need to be sure you won't break at the first sign of growth.

Do you know exactly how much money you need, what you'll spend it on, and what concrete milestones it will help you achieve? Vague asks get vague answers, or no answers at all.

Is your data room organised, complete, and ready for an investor's scrutiny, with all your legal, financial, and operational evidence in order? A messy data room screams 'disorganised business'.

Is your core team complete, with all the right skills and experience needed to execute the plan for the next 12-18 months? Even as the founder, you're not the only important person in this business.

Can you clearly articulate the 'why' behind your business (the big Mission and the problem you're solving) with authentic passion and unwavering confidence? People invest in passion as much as they do in numbers.

Have you relentlessly practised your pitch and received honest feedback from trusted advisors or mentors? Your pitch is your one shot to make a first impression and it's very easy for that impression to be 'waaaay too much preamble'.

Are you personally ready to handle the pressure, the inevitable rejections, and the constant scrutiny that comes with a fundraise? This process is a marathon, not a sprint, and you need to be mentally and emotionally prepared for the journey ahead.

Take the time to answer these questions honestly. Your answers will give you a pretty good indication of whether you're actually ready to even try to book these meetings, let alone to perform well in them.

If you’re struggling to answer any of them, or want any additional help, just give us a shout via the link below or why not get ahead of the game and take a free Investment Readiness Healthcheck to assess how you're doing across all 6 of the categories?

Otherwise, I'll see you next time we'll be diving into the final article in this series, which will look at how to figure out what your ideal investor looks like and how to build a foolproof process for getting in touch with them.

.png)

.png)

Comments