Investment Readiness: Is Your Data Room Investible?

- Milly Barker

- Aug 8, 2025

- 10 min read

Updated: Sep 24, 2025

We're back with the next article in the Investment Readiness series.

In this series of articles, we're learning about all the critical areas of your business that investors will inspect when you're going out and asking them for sweet, sweet piles of cash to build your dreams.

We're covering:

Strategy: how to define, refine, and document your path forward

Operations: assessing and optimising for genuine scalability

Finance: building robust models and projections that stand up to scrutiny

Data Room/Collateral: preparing comprehensive due diligence materials and data rooms (this article)

Coaching: getting ready for the tough questions with investment meeting and Q&A coaching

Investment Strategy: mastering cap table planning and investor identification

I'm writing this series (in part, I'm also writing it because it's really useful) because we just launched a new Investment Readiness service to help startup and scaleup Founders and Operators get the best raises on the best terms by honing their operational effectiveness - we call that service 'Op Eff It' because there are few things I love more than a cute play on words.

If this is the first article you're reading in the series, I recommend checking out the previous ones in the links above as they set the context for this one.

Or, if you can't wait for the rest of the series, why not get ahead of the game and take Op Eff It's free Investment Readiness Healthcheck to assess how you're doing right now across all 6 of the categories?

I’ve, once again, got my new favourite co-author with me, Will Herrmann.

Will has partnered with me on Op Eff It and brought a huge amount of his expertise to the table. Will has over 20 years of experience in strategy, operations and finance having spent ten years in management consultancy with Accenture before moving into COO/CFO roles in startup, VC and charity, so he brings broad and really rare perspective as well as extensive practical experience to the topic of Investment Readiness and I’m excited for you to hear his thoughts.

Ok, let’s talk about data rooms and due diligence. So far, you've crafted your Strategy (the map of where you’re taking the business), you’ve fine-tuned your operations (what’s powering you forwards). And you’ve built your finances (how you showcase how well it’s all working). Now for the moment of truth and sometimes the most painful part of any fundraise: due diligence.

This is where all that hard work is put to the ultimate test. Think of this phase of securing investment as the comprehensive exam for your business, where investors scrutinise every single claim you’ve made to make sure it's as sound as you say it is. And all the paperwork they’ll be checking? That’s what’s in your data room.

Your data room is the secure, digital repository for everything that proves your business is what you say it is. And a well-organised and accessible data room is a powerful statement to make to your potential investors. It shows your operational maturity, your readiness for scrutiny, and ultimately, it builds the trust that gets a deal over the line.

What is a ‘data room’ (in the context of investment readiness?)

Your data room is a secure, cloud-based folder where you store all the essential documents that prove your business is as solid as you say it is. Investors are going to use it to verify every claim from your pitch deck, so it’s going to need to contain a lot of information.

And that information needs to be organised. A founder who's got their documents in order is a founder who's got their business in order; the idealised vision of a chaotic genius is just that - it’s idealised, it’s not in reality the impression that you want to be giving off when you’re asking for shiny piles of cash.

To keep things sane and show investors you're not a chaotic mess, you should organise your data room into logical categories, which you can use as subfolders. Here's a breakdown of what those categories should be, and what you should stash in them:

1. Corporate & Legal

This is the dry (please don’t tell my lawyer I said that) but essential stuff that proves your company is properly formed and legally sound. At a minimum, you should be including:

Certificate of Incorporation and Articles of Association

Companies House filings (e.g., confirmation statements)

Board meeting minutes and resolutions - yes, you need these even when you’re small

Shareholder agreements

Any past investment documents

Key legal agreements (e.g., leases, licenses, terms of service)

2. Financials

As we've already discussed, these are the documents that tell your company's story in numbers.

Historical financial statements (P&L, balance sheet, cash flow)

Current and projected financial models

Management accounts (monthly/quarterly)

Cap table (who owns what in the company)

Tax filings and R&D tax credit claims

3. IP & Technology

This is a critical section, especially for a company with any kind of tech making up the foundation of a competitive moat. It proves you own your magic and have an advantage over anyone else that want to join the battle for market share:

IP registrations (patents, trademarks)

Documentation of IP assignment from founders and key staff

Software licenses

List of your technology stack

Key development agreements

4. Operations & Commercial

This is the folder that shows you can actually execute your strategy and grow. It's the physical manifestation of your operational effectiveness.

Key customer contracts and agreements

Supplier and vendor agreements

Sales and marketing materials

Operational process documents and manuals

Key performance indicator (KPI) dashboards

Leadership / Management Meeting Decks and Notes

Risk, Actions, Issues & Decisions (RAID) Documentation

5. HR & Team

This is all about the people who make your business tick. Investors want to see you have the right talent and have managed the legalities around them.

Employment contracts for key hires and founder agreements

Staff handbook and key policies

Organisational chart

Details of any stock option plans, including vesting schedules

Team skills assessment and gap analysis

Performance review documentation

6. Market & Strategy

This folder demonstrates your understanding of the market and where you plan to go with the business.

Your latest pitch deck

Strategic plan and product roadmap

Market research and analysis

Competitor analysis

Relevant industry report

Why is your data room so important to your investment readiness (but also to your business in general)?

Look, I’ve worked with founders for long enough to be able to actually hear the sound of eyes rolling when reading that long, long list of documents that needs to be pulled together. I know you’ve got a hell of a lot on your plate, I know how draining a fundraise is, I know how important it is to have time to focus on customers as well as on investors, so I don’t ask people to pull this level of information together lightly.

I know you might be thinking it’s a lot of work upfront and wondering if you can just wait until you’re asked for it.

To be brutally honest? No, you can’t.

Your data room isn’t just a folder full of stuff for investors. It’s how you show that you’ve got your shit together enough to handle the responsibility of growing your business.

And here’s the thing: you shouldn’t just be doing it for investors. You should be doing it for yourself. These are the documents, insights, and structures that you should want to have at your fingertips - not because someone asked, but because you’re running a company that deserves to be taken seriously.

You can’t cut corners here, and there are two massive reasons why.

A good data room builds trust with investors

A messy, incomplete, or chaotic data room is a massive red flag for investors.

It immediately suggests that your company is just as disorganised, which is a huge turn-off for any investor looking for a scalable, well-run business. A clean, logical, and complete data room, however, tells a different story. It says that you’ve got our act together, that you’re on top of your legalities, your financials, and your processes. It’s also making the investor's job easier, which is something they'll definitely appreciate. If you’re waiting for an investor to ask for something that you know they’re going to need then you’re just adding friction to their day and it’s going to be really easy for them to prioritise other companies that don’t do that.

A good data room helps investors meet their fiduciary duties

Second, and perhaps more importantly, it's about the investor's fiduciary duty.

Remember, most professional investors, like VCs, aren't just investing their own cash. They're investing money on behalf of others - their Limited Partners (LPs), who are typically pension funds, university endowments, and other institutions.

Investors have a legal and ethical obligation to protect and grow that capital. This means they must be able to prove, with tangible evidence, that they did their homework on your company. Your data room is that proof. If your data room is a shambles, the investor can't confidently report back to their LPs that they've performed proper due diligence.

How do you get your data room into a state of investment readiness?

The list of documents is long, and the job ahead is a big one. The key to not getting completely overwhelmed is to approach this systematically, but I'll be entirely honest with you: this is a hands-on, relentless, and time-consuming job that will pull you away from the day-to-day running of your business.

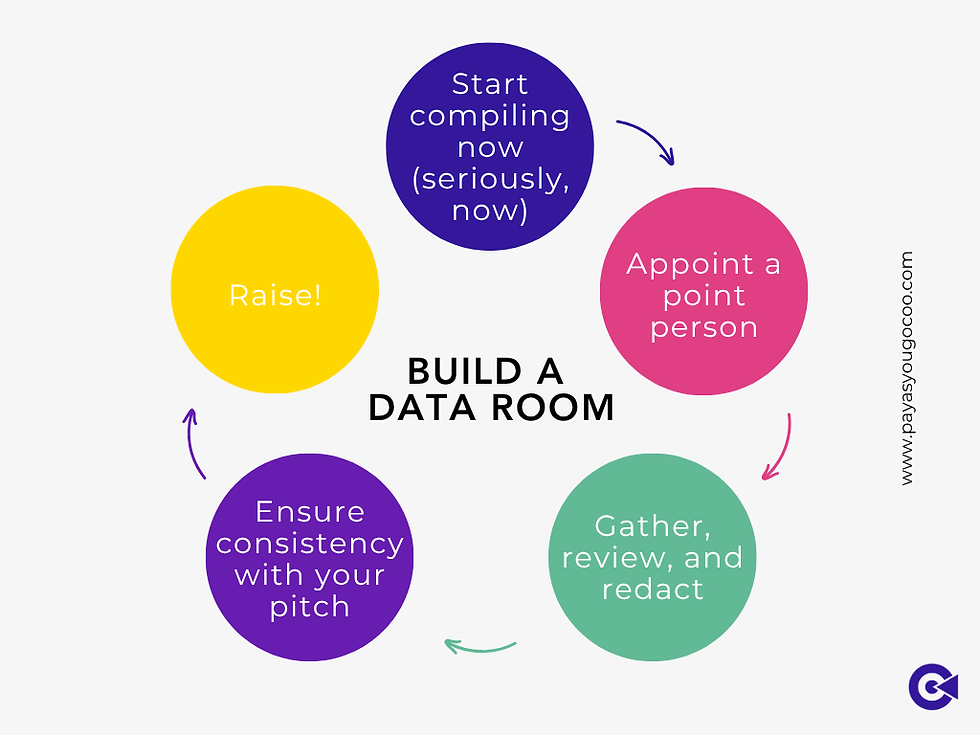

Here’s the step-by-step approach to getting your data room sorted:

Start compiling now (seriously, now)

The biggest mistake you can make is to wait until a term sheet arrives. DD is typically a 4-6 week sprint, and you won’t have the time to find and organise everything then. The best time to start putting your data room together is yesterday. The second best time is today. If you’re thinking about going out to raise investment, start compiling the documents now. Use the folder structure we outlined as your checklist and work through it.

Appoint a point person

When everyone is responsible for something, no-one is responsible for it. This cannot be a job for everyone. Appoint one person (or if you have enough people, a small team) to own this project.

They need to be meticulous, organised, and have the authority to chase down the right information from across the business. Be warned, to do this well, this will need to be their primary focus in the immediate term, so it will take them away from other responsibilities.

Gather, review, and redact

This is where the real time-suck happens.

You’ll be digging through old contracts, board minutes, and legal filings. You'll need to review each one for accuracy and make sure there are no glaring inconsistencies. If any documents contain sensitive information that isn't relevant to the investor, you'll need to meticulously redact it. This part is tedious, but it’s critical.

Ensure consistency with your pitch

Remember that your data room is the proof behind your pitch. Every claim you make, every number you use, every team member you mention, needs to be consistently backed up by a document in that data room. Any inconsistencies are a massive red flag that can derail a deal. Set reminders to check if changes are needed if the raise is taking a while and the team or GTM plans are shifting.

Make it accessible, but secure

Once the documents are gathered and organised, you'll need to upload them to a secure, password-protected digital data room. It should be easy for investors and their advisors to navigate, but with access controls to ensure the right people are seeing the right information. There are some great SaaS tools available to help you with this, but a lot of them are quite spendy, so it’s worth shopping around.

This is a big job. A hands-on, time-consuming, relentless big job (there isn’t really much about the fundraising process that isn’t). And every minute you spend on this is a minute you're not spending on the most important things for a startup, like talking to customers, closing sales, perfecting your product, and leading your team.

This is exactly the kind of support Will and I provide for founders through our Investment Readiness services.

We've spent years getting to know what investors look for, how to get documents organised, and how to spot the red flags before they do. Handing this work over to experts like us means you get a professional, watertight data room built to the highest standard, without you having to take your eye off the ball. It means you can stay focused on what you do best: building a great company.

If that sounds like something you’d enjoy, why not book a free, no-strings call with us to learn more.

Is your data room showcasing your investment readiness?

If you’re wondering how ‘ready’ for investment your data room and the information inside it are, here are 10 questions you can ask yourself to determine if your company's financial story is genuinely ready to be put in front of investors.

Answer these ten questions honestly to start to get an answer on where the current gaps are.

Is your data room clearly organised into logical, easy-to-navigate folders? If an investor can't find what they're looking for in under a minute, you're already creating a blocker.

Have you gathered and included all the essential documents across all key categories (legal, financials, HR, operations, etc.)? A comprehensive data room shows that you've got your act together across the entire business, not just the ‘sexy’ bits.

Is every claim you make in your pitch deck and financial model consistently backed up by a document in your data room? Any discrepancy between your story and your proof is a major warning sign.

Is all the information and documentation in your data room up-to-date and accurate? An outdated cap table or old financial records will immediately raise questions about your attention to detail and may even look like a deliberate omission.

Does your data room contain compelling evidence of your key operational processes, metrics, and workflows? Investors want to see the 'how,' not just the 'what' of your business.

Have you documented and assigned all of your company's intellectual property (IP) to ensure you clearly own your magic? For IP-rich businesses, this is absolutely non-negotiable.

Is your documentation easy for a non-expert to understand, or is it full of internal jargon and acronyms? Remember, investors will be sharing this with lawyers and accountants who won't be familiar with your inner workings.

Did you start building your data room well before you needed it, or was it a last-minute scramble? Your preparedness is a direct reflection of your company's operational discipline.

Does your HR folder clearly outline founder agreements, key contracts, and your team structure? Investors are betting on the team, and they want to see that the team is legally sound and organised.

If you were an investor, would a quick scan of your data room fill you with confidence, or would you see obvious signs of a disorganised business? This is your ultimate gut-check. Be honest with yourself.

Take the time to answer these questions honestly. Your answers will give you a pretty good indication of whether your data room and its collateral are robust enough to attract the right investment.

If you’re struggling to answer any of them, or want any additional help, just give me a shout via the link below or why not get ahead of the game and take a free Investment Readiness Healthcheck to assess how you're doing across all 6 of the categories?

Otherwise, I'll see you next time we'll be diving into how ready you are to answer the tough questions that will come your way as investors start to explore all of these pieces of information that you’ve put together.

.png)

Comments